Media Room

For media inquiries, please contact Gigi Jones at gjones@ctec.org or call 916.296.6913.

Blog

Stay updated on CTEC requirements and podcast episodes.

Press Releases

Get CTEC updates and taxpayer tips.

Taxpayer Tips

Ask for current credentials

In California, only CPAs and their employees, attorneys with the State Bar of California, tax preparers registered with CTEC, or enrolled agents with the IRS can prepare tax returns for a fee. All professionals should willingly provide proof of their license, enrollment, or registration. CTEC registrants are required to have their certificate in a visible location.

Verify their legal status through CTEC or one of these organizations

- Look for a CTEC certificate in their office

- Search “Verify a Preparer” on the CTEC website or call 877.850.CTEC (2832)

- Ask to see proof of a $5,000 surety bond

- Look for a wall certificate in their office

- Go to cba.ca.gov and click on “License Lookup”

- Look for a wall certificate in their office

- Call the IRS Office of Professional Responsibility at (313) 234-1280 or verify through the IRS website at irs.treasury.gov/rpo/rpo.jsf

- Look for a wall certificate in their office

- Go to calbar.org and click on “Attorney Search”

Ask how they charge fees

Reasonable fees vary, but the cost of the tax preparation should never be based on the refund amount. It should be based on the complexity of your tax return.

Ask how long they have been preparing tax returns

Don’t be shy. Filing your tax return is the most important financial transaction you do each year. It is important you feel comfortable with the professional you hire.

Verify if they will be available year-round

Legitimate tax preparers will be available for clients year-round.

Verify how you will receive your refund (direct deposit or through mail)

Refunds should go directly to you. Beware of tax preparers who claim refunds should go to their bank account instead of yours.

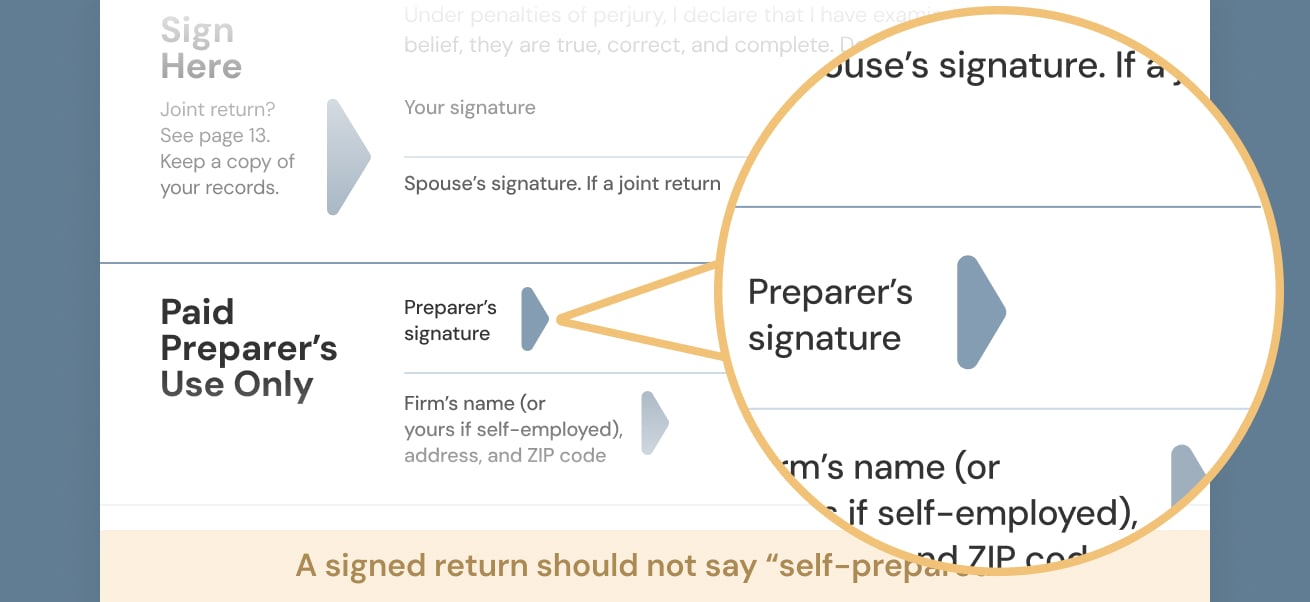

Ask if they will sign your tax return

The answer should always be YES. Paid tax preparers are also required to obtain an IRS Preparer Tax Identification Number (PTIN) and include it on all tax returns they prepare for clients. Tax preparers who sign tax returns with a business label should also be questioned. A signature (typed or handwritten) and PTIN is required. Business labels do not meet federal or state standards.

Do you need to file a complaint about a Tax Preparer?

- Anyone advertising guaranteed refunds may not be a reputable tax preparer. The only guarantee a tax preparer can provide is that you will either pay the least amount owed or get the most amount allowed based on current tax laws.

- Beware of tax preparers who take a percentage of your refund as compensation.

- The tax preparer should offer you an opportunity to ask them questions about your tax return before you sign.

- Double check if your name, address, and social security number(s) are accurate. Also review the list of deductibles and dependents. This is where most fraud happens. In the most obvious lists. You may not know tax law, but you know your life. Always double check.

- Do not be embarrassed to ask questions.

- Verify they will assist you with any letters from the IRS or California Franchise Tax Board (FTB).

- The filed tax return should be completed by a computer, typewriter, or written in ink—not in pencil.

- Never sign a blank tax return.

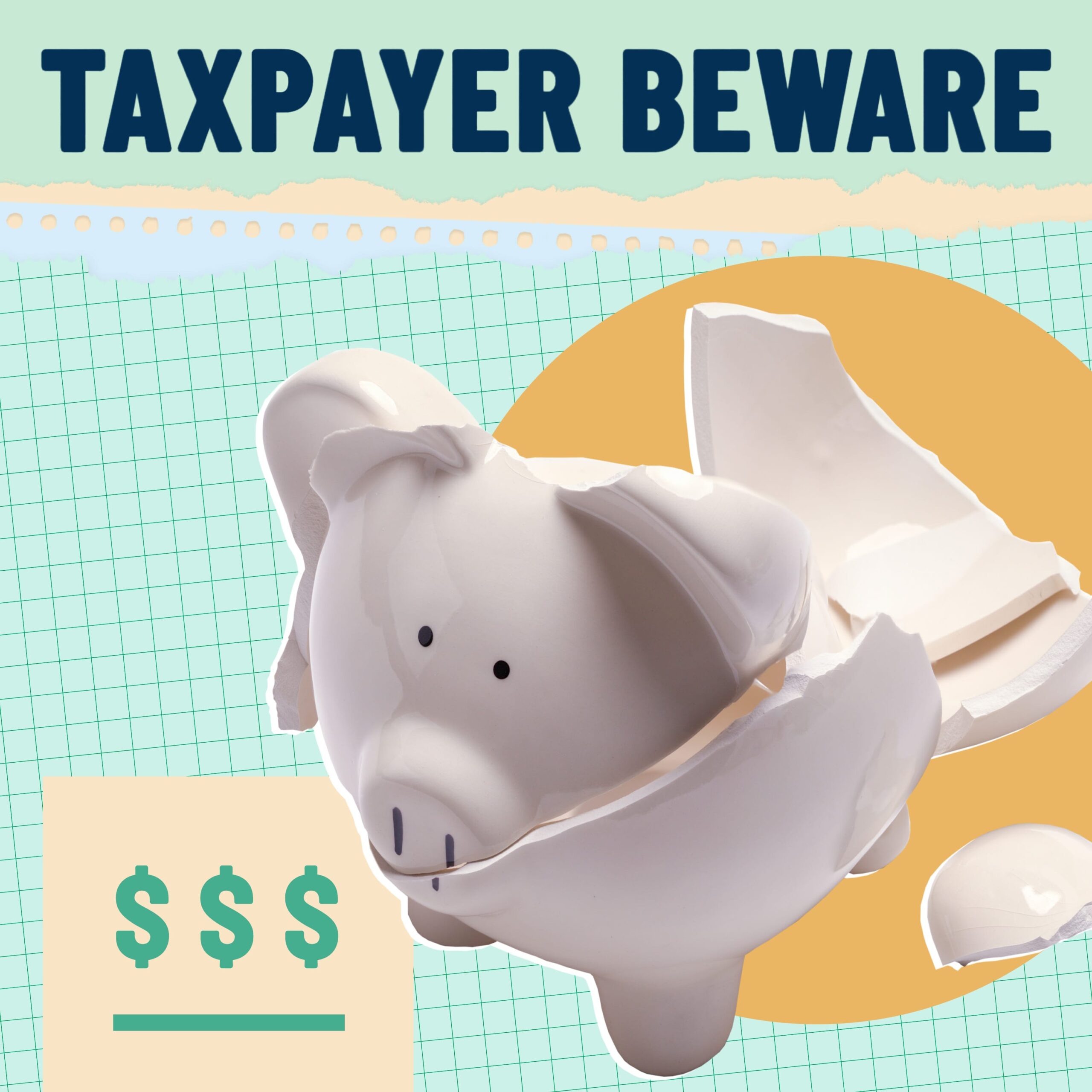

Podcasts

Download the Taxpayer Beware podcast. Also available in Spanish. To hear all seasons in English, visit taxpayerbeware.org. To hear all seasons in Spanish, visit contribuyentecuidese.org.

Detecte y Evite Estafas de Impuestos Ya

How to Outsmart Tax Scams

Tiene un problema con su preparador de impuestos. ¿Y ahora qué?

Cuidado con las estafas fiscales en redes sociales

Avoiding Social Media Scammers

Beware the Scam: A Tax Fraud Victim’s Story

Videos

Get quick tips on how to choose a tax preparer and avoid fraud.