Protecting You. It’s What We Do.

Your personal and financial information deserve the highest level of protection. In California, only attorneys, CPAs and their employees, IRS-enrolled agents, and CTEC-registered tax preparers (CRTPs) meet the strict requirements to legally prepare your tax return for a fee. Don’t take chances with your taxes—always verify your preparer.

Preparer Checklist:

- They must display their credentials.

- They must give you a written receipt and sign your return.

- They’re required to follow federal and state tax laws – protecting you from fraud.

Taxpayer Tips

Ask for current credentials

In California, only CPAs and their employees, attorneys with the State Bar of California, tax preparers registered with CTEC, or enrolled agents with the IRS can prepare tax returns for a fee. All professionals should willingly provide proof of their license, enrollment, or registration. CTEC registrants are required to have their certificate in a visible location.

Verify their legal status through CTEC or one of these organizations

- Look for a CTEC certificate in their office

- Search “Verify a Preparer” on the CTEC website or call 877.850.CTEC (2832)

- Ask to see proof of a $5,000 surety bond

- Look for a wall certificate in their office

- Go to cba.ca.gov and click on “License Lookup”

- Look for a wall certificate in their office

- Call the IRS Office of Professional Responsibility at (313) 234-1280 or verify through the IRS website at irs.treasury.gov/rpo/rpo.jsf

- Look for a wall certificate in their office

- Go to calbar.org and click on “Attorney Search”

Ask how they charge fees

Reasonable fees vary, but the cost of the tax preparation should never be based on the refund amount. It should be based on the complexity of your tax return.

Ask how long they have been preparing tax returns

Don’t be shy. Filing your tax return is the most important financial transaction you do each year. It is important you feel comfortable with the professional you hire.

Verify if they will be available year-round

Legitimate tax preparers will be available for clients year-round.

Verify how you will receive your refund (direct deposit or through mail)

Refunds should go directly to you. Beware of tax preparers who claim refunds should go to their bank account instead of yours.

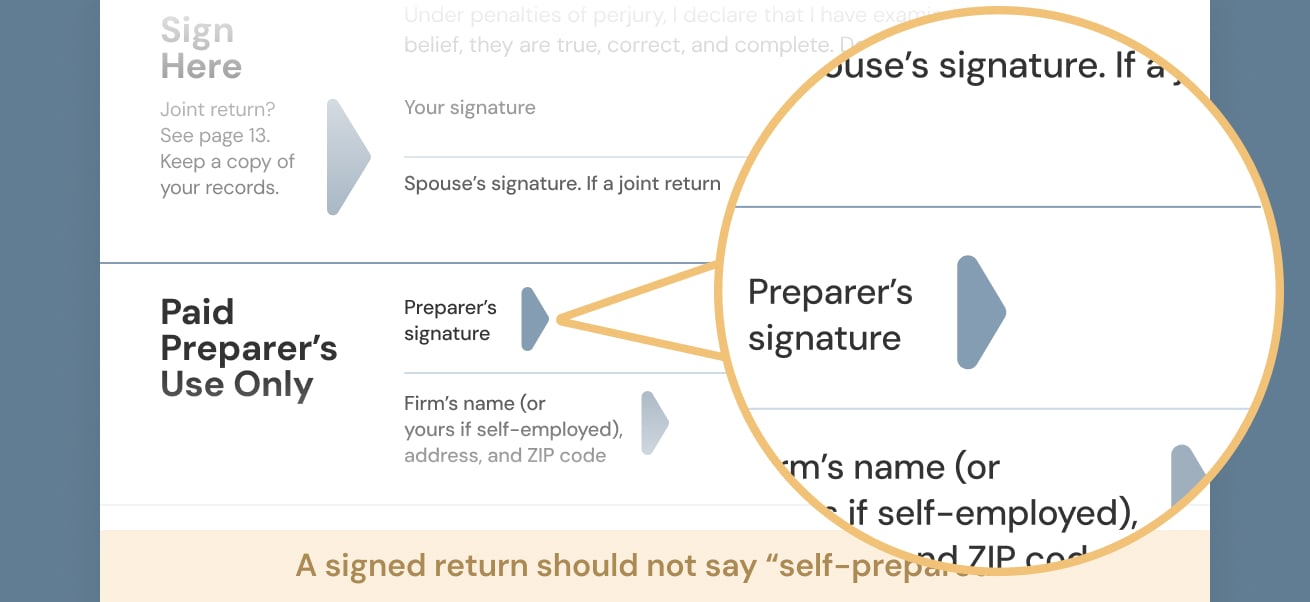

Ask if they will sign your tax return

The answer should always be YES. Paid tax preparers are also required to obtain an IRS Preparer Tax Identification Number (PTIN) and include it on all tax returns they prepare for clients. Tax preparers who sign tax returns with a business label should also be questioned. A signature (typed or handwritten) and PTIN is required. Business labels do not meet federal or state standards.

Do you need to file a complaint about a Tax Preparer?

- Anyone advertising guaranteed refunds may not be a reputable tax preparer. The only guarantee a tax preparer can provide is that you will either pay the least amount owed or get the most amount allowed based on current tax laws.

- Beware of tax preparers who take a percentage of your refund as compensation.

- The tax preparer should offer you an opportunity to ask them questions about your tax return before you sign.

- Double check if your name, address, and social security number(s) are accurate. Also review the list of deductibles and dependents. This is where most fraud happens. In the most obvious lists. You may not know tax law, but you know your life. Always double check.

- Do not be embarrassed to ask questions.

- Verify they will assist you with any letters from the IRS or California Franchise Tax Board (FTB).

- The filed tax return should be completed by a computer, typewriter, or written in ink—not in pencil.

- Never sign a blank tax return.

Videos

Get quick tips on how to choose a tax preparer and avoid fraud.

¿Su preparador de impuestos está aprobado por el estado de California?

Is Your Tax Preparer California Approved?

Know Your Tax Preparer

Conozca A Su Preparador De Impuestos

If you pay, they must sign.

Si Usted Paga, Deben Firmar

Share This to Keep Others Safe

Ready to double-check? Use our official CTEC Preparer Search Tool to verify your tax preparer in seconds.

Scammers Don’t Sign Returns—Beware.

He trusted his tax preparer — and it cost him thousands.

Hear one taxpayer’s real story — and how you can protect yourself.

Available in

and

.

A legitimate tax preparer will always sign your return and provide proof of a credential. If a preparer refuses to sign your return, they are breaking the law.

Checklist:

- Make sure the preparer signs by name and includes an IRS Preparer Tax Identification Number (PTIN).

- Beware of preparers who sign your return as “self prepared” or with a business label.

- Never sign a blank or partially filled return.

- Always get a copy of your completed return.

In California, paid tax preparation must be done by:

- An Attorney

- A CPA (Certified Public Accountant)

- A CTEC Registered Tax Preparer (CRTP)

- An Enrolled Agent (EA)

If the individual preparing your return does not fall into one of these categories, they may be operating illegally.

Why This Matters

Tax preparation is regulated to protect taxpayers. If your return is prepared by someone who is not properly credentialed:

- You may have little recourse if errors are made

- Your refund could be delayed or mishandled

- You may not be protected by required consumer safeguards, such as a surety bond

Even if tax preparation is marketed as a “convenient extra service,” your financial and personal information is still at risk.

Protect Yourself

Before providing your Social Security number or financial documents:

- Ask for the preparer’s credential (CPA, EA, Attorney, or CRTP)

- Request their CTEC registration number, if applicable

- Verify their status using CTEC’s online search tool

It only takes a moment to verify — and it can prevent serious problems later.